Don’t make things unnecessarily difficult and then say “it’s for security”.

At this point I hope most everyone knows basics about online security like don’t reuse passwords, use unique passwords at each site, use complex passwords, use multi-factor authentication when available, and use a password safe. These are all components that rely on the user (yes, in a corporate environment these things should be controlled by the IT department). The user though is only part of the security equation.

The website owner also needs to contribute to a secure online experience. And I submit that making access and credential requirements proportional to the criticality of the information available in the account is part of that responsibility. After all, if your credential isn’t easy to use or needs to be changed because of some requirement that isn’t an issue for any other website it doesn’t exactly make you want to use the website or promote it to family and friends.

This is a tale of a website which, IMHO, has account credential practices that are unnecessary and antithetical to positive user experience. Also they are not proportional to the value of what’s being protected and are uniquely cumbersome compared to any other websites I have credentials at.

I have a credit card. Surprised? It has a rewards program. The rewards program website is separate from the credit card company website. It is a third party provider of credit card reward program services, CU Rewards. And it has two “security features” that to me are absolutely abhorrent.

First is its CAPTCHA to prove I’m not a robot. I’m not against CAPTCHAs. I don’t mind them and they’re on many sites that I use. However the CU Rewards website CAPTCHA is one that regularly requires me to complete two, three, or more “click on all the …” CAPTCHA challenges to prove I’m real.

C’mon, really? Every other website I use that has CAPTCHA, it takes one challenge before it decides I’m not a robot. CU Rewards, never only one challenge. Why?

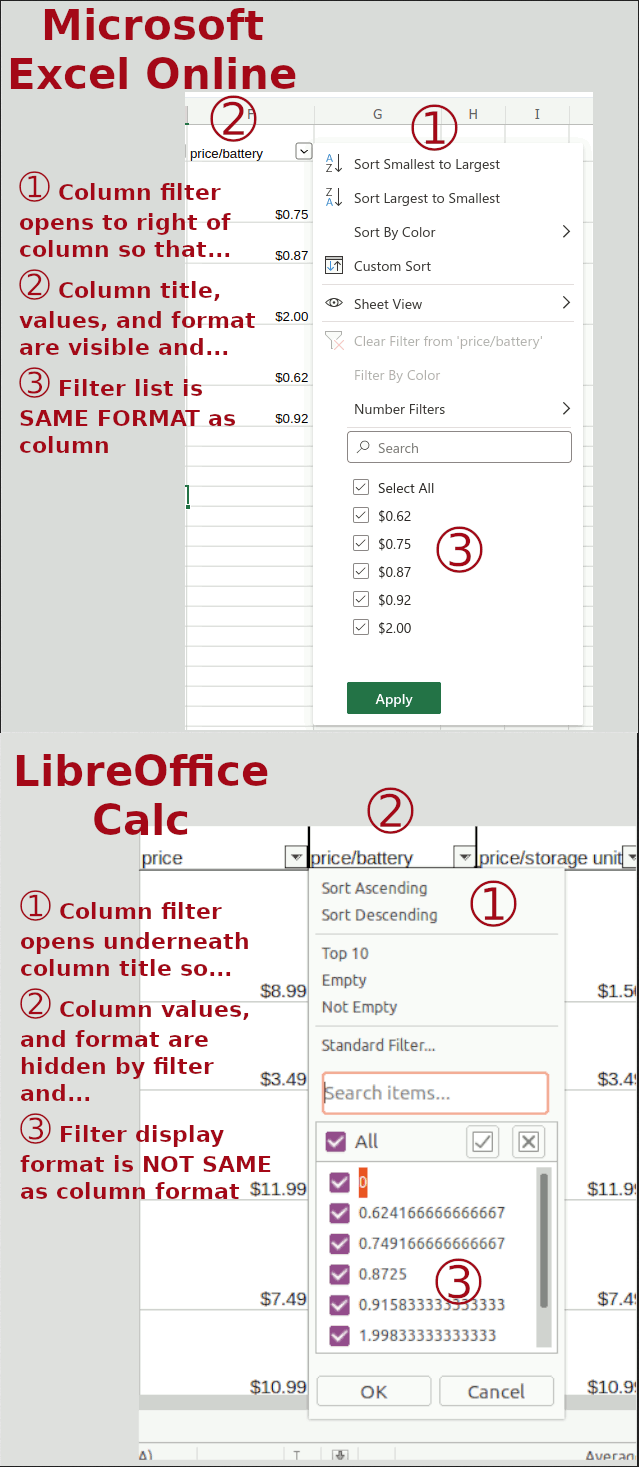

The images are lower resolution than most but certainly not the lowest. Why make access so difficult when I’ve already provided my credentials? What’s being protected? My retirement savings, no. My bank account with it’s wad of cash, no. My medical record with all that PHI (Protected Health Information), no. What’s being protected is my ability to order “free” stuff that is available on my credit card rewards program. This degree of difficulty to gain access does not make sense. It is not at all proportional to the value of what’s being protected.

The second issue with this website’s security is credential creation. I do use a password safe. I do use complex passwords. I do not reuse passwords. I have user accounts with banks, investment companies, retirement accounts, schools, job boards, etc. The list goes on and on. If my credential needs to change at any one of these websites, even those that require a user name separate from my email address, what needs to change is my password. Nothing else.

Imagine if you will a financial institution issuing you a credit card and you create a user credential to have online access to your information. Eventually they send you a new card. Maybe you lost your card, maybe you suspect some fraud and got it replaced, maybe it was about to expire and the replacement card was sent as a routine part of the account management process. Or how about an investment account where you’ve invested in stocks and index funds through your employer’s savings plan but have left the employer, managed the investments yourself for a while and then turned over fund management to an investment management company.

How many NEW user ids do you imagine needing to create for the above scenarios? Maybe a new one each time the credit card company issues you a new card and, for the investments, a new one when leaving the employer and then another new one on giving the investment management company the responsibility to manage the investments. Seems crazy right? You’re still you. The company you’re doing business with is still the same credit card company or same financial services company. You wouldn’t expect to need to create a new user name and password for any of these changes, would you? You’ve probably had some of these changes happen and not had to create new login credentials.

And yet CU Rewards requires a new login id be created whenever a new credit card is issued even though the card is from the same financial institution and is replacing your previous card. After being issued the new card your account information is still accessible at the financial institution using the same login credentials you’ve always used. The new card continues to accumulate points on the same CU Rewards program even automatically transferring the points balance from your old card to the new one. However CU Rewards won’t give you access to your account without creating a new user name and password?!

This, in my opinion, is absolutely TERRIBLE security design. It creates unnecessary barriers to the user and is not at all proportional to the value of what’s being protected. The requirement is 100% unique among all my other online credentials which is an indicator nobody else thinks it is a good process either. There is not a single other business be it bank, credit card company, finance company, mortgage, investment, insurance, medical records, or online retailers that requires a new login credential be created when a new credit card is issued.

CU Rewards your credential practices suck. You need to change them to stop sucking.